- The White House said it will guarantee buying some oil from drillers to replenish an emergency reserve.

- The Strategic Petroleum Reserve is releasing oil at record levels to help cut gas prices.

- Gas prices keep dropping, but it's largely due to cooling demand for fuel.

More gas price relief could be on the way for cash-strapped Americans as the government continues to tap into oil from its stockpile.

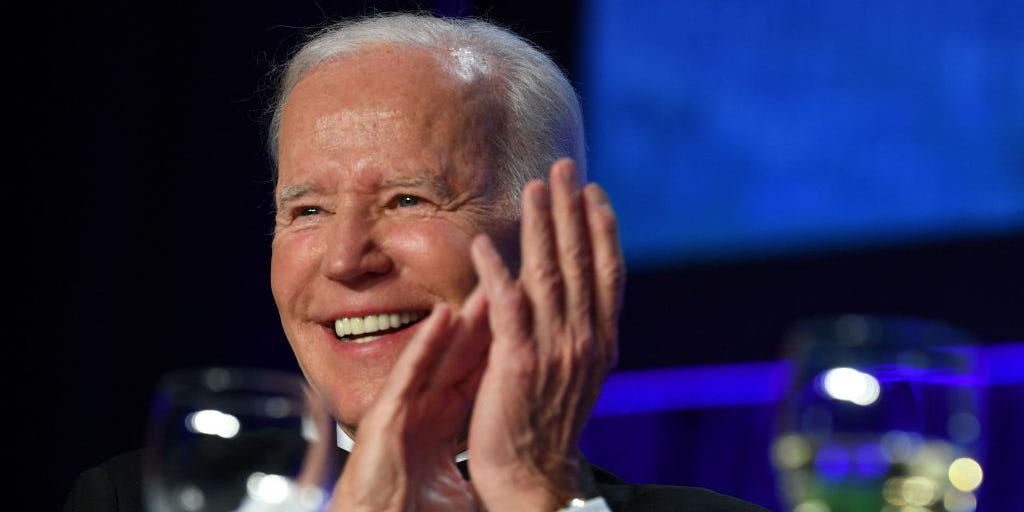

On Tuesday, the Biden administration announced it would release even more crude oil from the Strategic Petroleum Reserve (SPR) — and work to replenish that SPR's supply. The White House would do so by establishing a federal guarantee to buy oil from some drillers at preset prices to help restock the SPR.

It seems to be an effort to encourage more domestic drilling during a stretch of a high gas prices. The Energy Department will soon put forward a rule helping them do that.

Per the release from the White House, over 125 million barrels of crude oil have already been sold since the government first began its "unprecedented" releases in March, and the reserve is set to release about 180 million barrels by the fall.

A report from the Department of Treasury estimates that releasing crude oil from the reserves has brought the prices of gasoline down by about 17 to 42 cents a gallon from where it would be without the federal action.

Gas prices began spiking in late February and early March, as the war in Ukraine prompted Biden to ban oil and gas imports from Russia. He said soaring gas prices were "Putin's price hike."W ithout Russian imports, the US was under more pressure to produce more oil, and fast — but the end of the fracking boom meant that wasn't happening, leading to prices going up even more. The plan to restock the strategic reserve at set prices is intended to sway producers to ramp up drilling.

For a car-dependent country without widespread adoption of non-oil-based energy, that means that Americans' wallets are getting squeezed by soaring gas prices. In June, inflation reached a 41-year-high; according to the Bureau of Labor Statistics's Consumer Price Index, skyrocketing gas prices fueled nearly half of the increase in inflation.

Yet gas prices have been declining for over a month, the product of a drop in demand. According to the US Energy Information Administration, the price of a gallon hit $4.33 for the week ending July 25. The current average gas price calculated by AAA is $4.327 a gallon, down from $4.90 a month ago.

"Gas prices have declined by an average of 69 cents per gallon over the past 42 days. That's six straight weeks of declines – and the fastest decline in over a decade!" White House Press Secretary Karine Jean-Pierre wrote on Twitter.

Patrick De Haan, the head of petroleum analysis at GasBuddy, wrote on Twitter that 11 states are seeing average prices below $4. However, he's skeptical that releasing crude oil from the reserves is the "key catalyst" leading to falling prices.

"Most of the decline is due to potential to economic slowdown (rising interest rates) and limited improvement in refined product inventories," as well as demand destruction, De Haan tweeted.

"My view is that the SPR release is lowering the ceiling on how oil prices could go, but not necessarily lowering the price of oil."

Dit artikel is oorspronkelijk verschenen op z24.nl